1. Introduction & Overview

What is a Security Token?

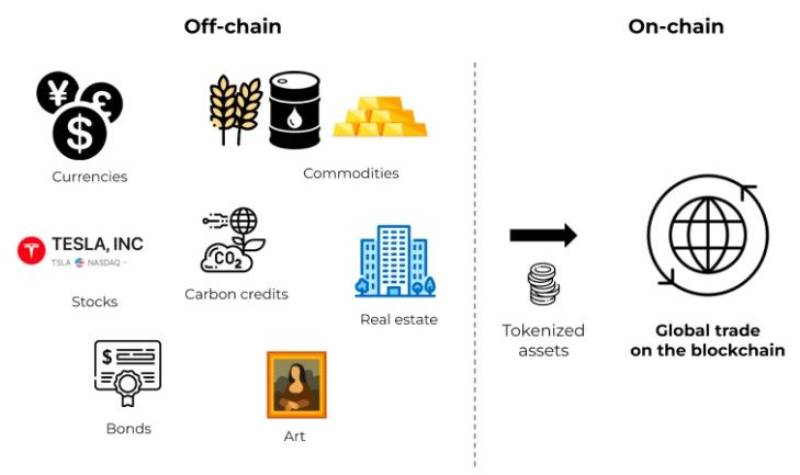

A Security Token is a digital representation of ownership in a real-world asset, regulated under securities laws. Unlike utility tokens that provide access to a platform, security tokens represent equity, debt, or other financial interests, and their issuance and transfer are subject to compliance with legal frameworks.

Key characteristics of Security Tokens:

- Represent real assets (stocks, bonds, real estate, etc.)

- Regulated under financial laws

- Often issued via blockchain-based smart contracts

- Can enable fractional ownership, increasing liquidity

History / Background

- 2008-2014: Bitcoin and early cryptocurrencies emerged, primarily as payment or utility tools.

- 2015-2017: ICO (Initial Coin Offering) boom—many tokens were unregulated, leading to scams.

- 2017 onwards: Introduction of Security Token Offerings (STOs) as a regulated alternative to ICOs.

- 2020s: Security Tokens gain traction in equity crowdfunding, real estate, and private investments due to legal clarity and blockchain benefits.

Why are Security Tokens relevant in Cryptoblockcoins?

- Enable compliance-driven fundraising

- Improve liquidity for traditionally illiquid assets

- Fractional ownership allows small investors to participate

- Transparency and auditability via blockchain

- Bridges traditional finance (TradFi) with decentralized finance (DeFi)

2. Core Concepts & Terminology

| Term | Definition | Importance in Security Tokens |

|---|---|---|

| STO (Security Token Offering) | Fundraising method using security tokens | Legal, compliant way to raise funds |

| Smart Contract | Self-executing contract with code and rules | Automates token issuance, transfer, and compliance |

| KYC/AML | Know Your Customer / Anti Money Laundering | Ensures investor legitimacy and regulatory compliance |

| Fractional Ownership | Dividing assets into smaller parts | Enables micro-investing and liquidity |

| Tokenized Asset | Real-world asset represented on blockchain | Bridges tangible assets with crypto infrastructure |

How Security Tokens fit into the Cryptoblockcoin Lifecycle

- Asset Selection: Choose real-world asset to tokenize

- Regulatory Compliance: Apply for approvals (SEC in US, ESMA in EU)

- Token Issuance: Deploy smart contract on blockchain

- Distribution: Sell tokens via STO platform

- Trading: Security tokens can be traded on regulated digital exchanges

- Redemption / Dividends: Token holders receive asset-linked returns

3. Architecture & How It Works

Components of Security Token Ecosystem

- Issuer: Entity creating the token

- Investor: Purchases token

- STO Platform / Exchange: Facilitates issuance and trading

- Smart Contract: Governs ownership, transfer, and compliance

- Regulatory Layer: Ensures KYC/AML, legal compliance

- Custody / Wallet Services: Safe storage for tokenized assets

Internal Workflow (Step-by-Step)

- Token Creation

- Asset valuation

- Define token economics (total supply, dividend structure)

- Compliance Integration

- Embed KYC/AML in smart contract

- Whitelist eligible investors

- Token Issuance

- Smart contract mints tokens

- Distributed to investor wallets

- Trading & Settlement

- Tokens traded on STO exchanges

- Settlement automated via smart contract

- Ongoing Management

- Dividend payouts, buybacks, voting rights

Architecture Diagram

(Since I can’t create an image here, here’s a descriptive diagram you can visualize or implement in a tool like Lucidchart/Draw.io)

+------------------+

| Issuer |

+------------------+

|

v

+------------------+

| Smart Contract |

| (Token Logic, |

| KYC/AML) |

+------------------+

|

+----------------+----------------+

| |

v v

+------------------+ +------------------+

| STO Platform | | Investor |

| (Exchange/ICO) | | (Wallet/Portfolio)|

+------------------+ +------------------+

|

v

+------------------+

| Regulatory Layer |

| (Compliance) |

+------------------+

Integration Points with CI/CD or Cloud Tools

- CI/CD Pipelines: Automate smart contract deployment, testing, and upgrades

- Cloud Platforms: AWS, Azure, or GCP for backend services (KYC/AML checks, token databases)

- Monitoring Tools: Track token issuance, transfers, and audit logs

4. Installation & Getting Started

Prerequisites

- Basic knowledge of blockchain & smart contracts

- Development environment: Node.js, Solidity (Ethereum), Hardhat or Truffle

- Wallet: MetaMask or any Web3-enabled wallet

- Testnet for experimentation: Ethereum Rinkeby or Polygon Mumbai

Step-by-Step Beginner Setup

1. Install Node.js and npm

sudo apt update

sudo apt install nodejs npm

2. Install Hardhat

npm install --save-dev hardhat

3. Initialize a Hardhat Project

npx hardhat

Choose: Create a sample project

4. Write a Simple Security Token Contract

// SPDX-License-Identifier: MIT

pragma solidity ^0.8.0;

import "@openzeppelin/contracts/token/ERC20/ERC20.sol";

contract SecurityToken is ERC20 {

address public issuer;

constructor(string memory name, string memory symbol, uint256 initialSupply) ERC20(name, symbol) {

issuer = msg.sender;

_mint(msg.sender, initialSupply);

}

function mint(address to, uint256 amount) external {

require(msg.sender == issuer, "Only issuer can mint");

_mint(to, amount);

}

}

5. Deploy on Testnet

npx hardhat run scripts/deploy.js --network rinkeby

6. Test Token Transfer & Compliance Logic

- Use wallet whitelisting

- Automate KYC checks

5. Real-World Use Cases

| Use Case | Example | Blockchain |

|---|---|---|

| Equity Crowdfunding | Polymath Security Tokens for startups | Ethereum |

| Real Estate Tokenization | Harbor Real Estate STOs | Ethereum |

| Debt Instruments | Securitize bonds | Ethereum |

| Private Equity Funds | Tokenized PE shares | Tezos, Stellar |

Industry-specific Examples:

- Real Estate: Allows fractional ownership of expensive properties

- Venture Capital: Startups can issue STOs to small investors

- Debt Markets: Tokenized bonds for efficient, automated settlement

6. Benefits & Limitations

Key Advantages

- Legal and regulated

- Transparent ownership

- Fractional investment opportunities

- Global investor reach

- Automated compliance and settlement

Common Challenges

- Regulatory complexity across countries

- Technology adoption barriers

- Limited liquidity in early markets

- Smart contract vulnerabilities

Comparison Table: Security Tokens vs Utility Tokens

| Feature | Security Token | Utility Token |

|---|---|---|

| Regulatory Status | Regulated | Usually unregulated |

| Ownership | Represents asset/equity | Represents platform access |

| Investor Rights | Dividends, voting, redemption | No ownership rights |

| Liquidity | Can be traded on STO exchanges | Platform dependent |

| Use Case | Fundraising, asset tokenization | Platform usage, rewards, services |

7. Best Practices & Recommendations

- Security: Audit smart contracts before deployment

- Compliance: Implement KYC/AML checks in smart contracts

- Performance: Optimize contract gas usage

- Maintenance: Monitor token transfers and dividend payouts

- Automation: CI/CD pipelines for continuous deployment and updates

8. Conclusion

Security Tokens bridge traditional finance and blockchain, enabling regulated, transparent, and global investment opportunities. With careful compliance and robust smart contract architecture, STOs can transform how companies raise capital and investors participate in markets.

Future Trends

- Integration with DeFi for liquidity

- Cross-border STO adoption

- AI-driven compliance and analytics

- Growth of tokenized private markets

Next Steps

- Start experimenting with testnet STOs

- Explore platforms like Polymath, Securitize

- Deepen knowledge of regulatory frameworks

Official Resources

- Polymath

- Securitize

- OpenZeppelin Security Token Contracts