Introduction & Overview

What is Miner?

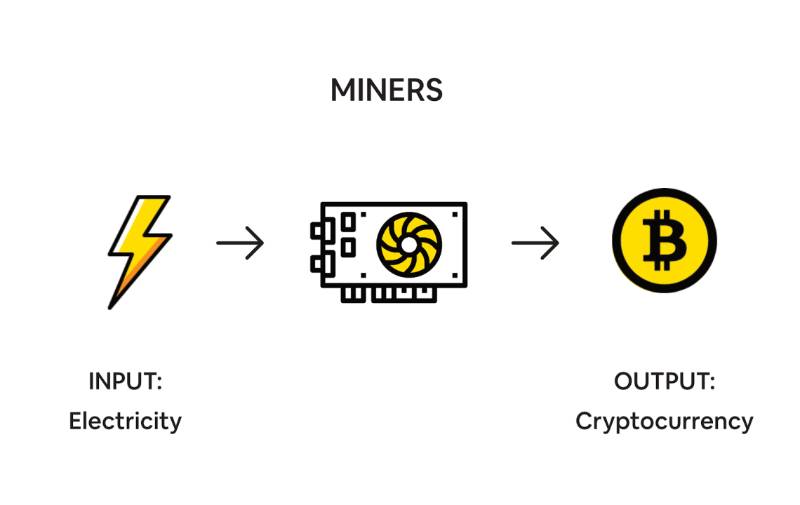

A Miner in cryptoblockcoins refers to a participant (individual, entity, or hardware/software setup) in a blockchain network that validates transactions, solves complex mathematical puzzles, and adds new blocks to the chain. This process is central to Proof-of-Work (PoW) consensus mechanisms, where miners compete to find a valid hash for a block. Theoretically, mining ensures network integrity by making it computationally expensive to alter transaction history, thus preventing attacks like double-spending.

In essence, a miner uses specialized hardware and software to perform hashing operations repeatedly until a target condition is met. Rewards include newly minted coins (block rewards) and transaction fees.

History or Background

Mining originated with Bitcoin, introduced by Satoshi Nakamoto in the 2008 whitepaper “Bitcoin: A Peer-to-Peer Electronic Cash System.” The first block (Genesis Block) was mined by Nakamoto on January 3, 2009. Initially, mining was feasible on standard CPUs, but as networks grew, it evolved:

- 2010–2011: Shift to GPUs for higher efficiency due to parallel processing capabilities.

- 2013: Introduction of Application-Specific Integrated Circuits (ASICs), custom chips optimized for hashing algorithms like SHA-256 (Bitcoin).

- 2010s–2020s: Rise of mining pools (e.g., F2Pool, AntPool) to combine computational power and share rewards, addressing the increasing difficulty.

- Post-2022: Ethereum’s transition from PoW to Proof-of-Stake (PoS) in “The Merge” reduced mining’s role in some chains, but PoW persists in Bitcoin, Litecoin, and others.

By 2025, mining has become industrialized, with operations in energy-rich regions like Iceland and Texas.

Why is it Relevant in Cryptoblockcoins?

Miners are the backbone of decentralized security in PoW-based cryptoblockcoins. They:

- Validate and timestamp transactions, ensuring immutability.

- Decentralize control, reducing reliance on central authorities.

- Enable economic incentives, driving network participation.

In a world of growing digital assets (e.g., NFTs, DeFi), mining secures trillions in value. It’s relevant for scalability debates, environmental concerns, and regulatory compliance, as governments scrutinize energy use.

Core Concepts & Terminology

Key Terms and Definitions

This section explains core concepts theoretically, with definitions in a table for quick reference.

| Term | Definition | Example in Context |

|---|---|---|

| Hashing | A one-way cryptographic function converting data into a fixed-size string (hash). Miners hash block data repeatedly. | SHA-256 in Bitcoin produces a 256-bit hash. |

| Nonce | A arbitrary number miners adjust to find a hash below the target difficulty. | Starting from 0, incremented until success. |

| Difficulty | A measure of how hard it is to find a valid hash; adjusts every 2016 blocks in Bitcoin to maintain ~10-minute block times. | Higher difficulty requires more computations. |

| Block Reward | New coins issued to the successful miner per block. | Bitcoin: Halves every 210,000 blocks (e.g., 6.25 BTC in 2025). |

| Mining Pool | A group of miners sharing resources and rewards proportionally. | Reduces variance in solo mining payouts. |

| Proof-of-Work (PoW) | Consensus algorithm where work (computations) proves block validity. | Contrasts with PoS, where stake replaces work. |

| ASIC | Hardware designed for specific algorithms, far more efficient than CPUs/GPUs. | Bitmain Antminer series for Bitcoin. |

How it Fits into the Cryptoblockcoins Lifecycle

Theoretically, mining integrates into the blockchain lifecycle as follows:

- Transaction Pooling: Users broadcast transactions; miners select and bundle them into a candidate block.

- Block Creation: Miners add a header (previous hash, timestamp, Merkle root, nonce) and hash it.

- Validation and Propagation: Successful blocks are broadcast; other nodes verify and append.

- Chain Maintenance: Longest chain rule resolves forks, ensuring consensus.

Mining sustains the lifecycle by incentivizing honest behavior—dishonest mining (e.g., 51% attacks) is costly.

Architecture & How It Works

Components, Internal Workflow

A miner’s architecture comprises hardware, software, and network layers. Theoretically, the workflow is iterative:

- Hardware Layer: CPUs (basic), GPUs (parallel tasks), ASICs (optimized for specific hashes).

- Software Layer: Mining clients (e.g., CGMiner, BFGMiner) interface with hardware, connect to pools, and manage hashing.

- Network Layer: Communicates with blockchain nodes via protocols like Stratum for pools.

Internal Workflow (Step-by-Step Theory):

- Fetch work from pool or node (candidate block template).

- Compute hash: Hash(block_header + nonce).

- If hash < difficulty target, submit solution; else, increment nonce and repeat.

- Upon success, propagate block; receive reward share.

Architecture Diagram (Describe if Image Not Possible)

Since image generation requires confirmation, here’s a detailed textual description of the architecture diagram (visualize as a flowchart):

- Top Level: User/Miner Interface – Connects to mining software (e.g., GUI or CLI).

- Arrow Down to: Software Client (e.g., CGMiner) – Manages job distribution, hashing algorithms.

- Sub-components: Stratum Protocol for pool communication; API for monitoring.

- Parallel Branches: Hardware Pools – Left: CPU/GPU rigs; Right: ASIC farms.

- Each branch shows hashing loop: Input (block data) → Process (hash + nonce) → Output (valid hash or retry).

- Bottom: Blockchain Network – Pools aggregate shares, submit to full nodes; nodes validate and add to chain.

- Feedback Loop: Difficulty adjustment from network → Back to software for recalibration.

- Key Flows: Dotted lines for monitoring (e.g., temperature, hashrate); Solid lines for data flow.

In ASCII art for clarity:

[User Interface] --> [Mining Software (CGMiner/BFGMiner)]

|

v

[Hardware (CPU/GPU/ASIC)] <--> [Hashing Engine (Nonce Iteration)]

|

v

[Mining Pool (Stratum)] <--> [Blockchain Nodes]

^

| (Difficulty Feedback)Integration Points with CI/CD or Cloud Tools

Miners integrate with DevOps for large-scale ops:

- CI/CD: Use Jenkins or GitHub Actions to automate software updates for mining rigs.

- Cloud Tools: AWS EC2/GPU instances for cloud mining; Kubernetes for orchestrating containerized miners.

- Monitoring: Prometheus/Grafana for hashrate metrics; integrate with alerting tools like Slack.

Installation & Getting Started

Basic Setup or Prerequisites

Prerequisites:

- Hardware: GPU (e.g., NVIDIA RTX 30-series) or ASIC; high-wattage PSU.

- Software: OS (Linux/Windows), drivers (CUDA for NVIDIA).

- Wallet: For receiving rewards (e.g., Bitcoin Core).

- Network: Stable internet; firewall ports open (e.g., 3333 for Stratum).

Hands-on: Step-by-Step Beginner-Friendly Setup Guide

We’ll set up GPU mining for Ethereum Classic (ETC, still PoW in 2025) using T-Rex miner. Full step-by-step:

- Install OS and Drivers:

- Download Ubuntu 22.04 LTS.

- Install NVIDIA drivers:

sudo apt update && sudo apt install nvidia-driver-535.2. Set Up Wallet:

- Create an ETC wallet via MyEtherWallet or hardware like Ledger.

- Note your address: e.g.,

0x123...abc.

3. Download Mining Software:

- Get T-Rex from GitHub:

wget https://github.com/trexminer/T-Rex/releases/download/0.26.8/t-rex-0.26.8-linux.tar.gz.- Extract:

tar -xvf t-rex-0.26.8-linux.tar.gz.4. Configure Miner:

- Create config file

config.json:

{

"pools": [

{

"url": "stratum+tcp://etc.2miners.com:1010",

"user": "YOUR_ETC_WALLET_ADDRESS",

"pass": "x"

}

],

"algo": "etchash",

"intensity": 25

}5. Run the Miner:

- Execute:

./t-rex -c config.json. - Monitor output for hashrate (e.g., 50 MH/s).

6. Join a Pool and Monitor:

- Sign up at 2miners.com; track shares via dashboard.

- Use

nvidia-smifor GPU stats.

Troubleshoot: If errors, check overclocking with nvidia-settings.

Real-World Use Cases

3 to 4 Real Cryptoblockcoins Scenarios or Examples

- Bitcoin Network Security: Large farms in China (pre-2021 ban) and now US use ASICs to mine BTC, securing $1T+ market cap. Example: Marathon Digital Holdings mines ~5% of network hashrate.

- Altcoin Mining for Profit: Individuals mine Ravencoin (RVN) with GPUs; profitable in low-energy regions. Scenario: Home setup yielding $5–10/day.

- Decentralized Finance (DeFi) Support: Mining on chains like Ergo supports smart contracts; used in DeFi lending platforms for transaction validation.

- Industry-Specific: Gaming/NFTs: Mining on Flux network powers decentralized cloud for games; miners earn by providing compute for NFT rendering.

Industry examples: In finance, banks like JPMorgan explore private mining for blockchain pilots; in energy, miners use excess renewable power (e.g., solar farms in Australia).

Benefits & Limitations

Key Advantages

- Decentralization: Distributes power, resistant to censorship.

- Economic Incentives: Rewards encourage participation; block subsidies bootstrap networks.

- Security: PoW makes attacks expensive (e.g., $10B+ for Bitcoin 51% attack).

Common Challenges or Limitations

- Energy Consumption: Bitcoin uses ~150 TWh/year, equivalent to Argentina’s usage.

- Centralization: Pools control >50% hashrate, risking collusion.

- Hardware Costs: ASICs cost $5K–10K; obsolescence with algorithm changes.

Table for Summary:

| Aspect | Benefits | Limitations |

|---|---|---|

| Security | High attack resistance | Vulnerable to 51% pool attacks |

| Cost | Profitable for large ops | High entry barrier for individuals |

| Environment | Can use renewables | Massive carbon footprint |

Best Practices & Recommendations

Security Tips, Performance, Maintenance

- Security: Use hardware wallets; enable 2FA on pools. Avoid public Wi-Fi.

- Performance: Overclock GPUs safely (e.g., +100MHz core); monitor temps <80°C.

- Maintenance: Regular dust cleaning; update software for bug fixes.

Compliance Alignment, Automation Ideas

- Compliance: Adhere to KYC in regulated pools; report earnings for taxes (e.g., IRS Form 1099).

- Automation: Script monitoring with Python:

import subprocess

import time

while True:

output = subprocess.check_output(['nvidia-smi'])

if '80 C' in output.decode(): # Alert on high temp

print("Overheat Alert!")

time.sleep(60)- Ideas: Use Ansible for rig orchestration; integrate with cloud autoscaling.

Comparison with Alternatives (if Applicable)

How it Compares with Similar Tools or Approaches

Miners (PoW) vs. Validators (PoS) or Delegated PoS (DPoS).

| Feature | Miner (PoW) | Validator (PoS) | DPoS (e.g., EOS) |

|---|---|---|---|

| Resource Use | High energy/hardware | Low; stake-based | Voting-based delegation |

| Security | Proven against attacks | Economic penalties for misbehavior | Faster but more centralized |

| Entry Barrier | Expensive rigs | Requires holding coins | Low for voters |

| Speed | Slower blocks (~10 min BTC) | Faster (e.g., 3s in Solana) | Very fast |

When to Choose [Miner] Over Others

Choose Miner/PoW for maximum security in high-value networks (e.g., Bitcoin). Opt for PoS in eco-friendly, scalable chains like Ethereum post-Merge.

Conclusion

In summary, Miners are essential for PoW cryptoblockcoins, providing security through computation while evolving amid environmental and tech shifts. Future trends include greener mining (e.g., hydro-powered) and hybrid consensus. Next steps: Start with a small GPU rig, experiment with pools, and monitor regulations.

Official Docs and Communities:

- Bitcoin: bitcoin.org (whitepaper, docs).

- Ethereum Classic: ethereumclassic.org.

- Communities: Reddit r/cryptomining, Bitcointalk.org.