1. Introduction & Overview

What is a Multi-Sig Wallet?

A Multi-Signature Wallet (Multi-Sig Wallet) is a digital cryptocurrency wallet that requires more than one private key to authorize a transaction. Unlike standard wallets that need only one private key, Multi-Sig wallets provide enhanced security, shared control, and redundancy.

- Definition: A wallet that needs M-of-N signatures (private keys) to approve transactions.

- M-of-N Notation: Out of N total owners, at least M must sign to authorize a transaction.

- Purpose: Prevents a single point of failure or misuse and is ideal for organizations, escrow services, and decentralized governance.

Example:

- 2-of-3 Multi-Sig Wallet → Three owners hold keys; at least two must sign for a transaction.

History or Background

- 2012: Bitcoin introduced the concept of Multi-Sig addresses (BIP 11 & BIP 16).

- Early Use Cases: Securing company treasury funds, preventing theft from individual compromised accounts.

- Evolution: Now widely used in Ethereum, Binance Smart Chain, and DeFi platforms for smart contract-based Multi-Sig.

Why Multi-Sig Wallets are Relevant in Cryptoblockcoins

- Security: Reduces risk of theft if one private key is compromised.

- Governance: Enables decentralized management of assets in DAOs and shared accounts.

- Redundancy: Provides backup if one key is lost.

- Trustless Escrow: Used in DeFi and cross-party transactions without intermediaries.

2. Core Concepts & Terminology

| Term | Definition |

|---|---|

| Private Key | Secret key controlling funds in a wallet. |

| Public Key | Cryptographic key derived from the private key, used to generate addresses. |

| M-of-N Signature | Transaction requires M signatures out of N total possible signers. |

| Threshold | Minimum number of signatures required to validate a transaction. |

| Seed Phrase | Backup to recover wallet keys. |

| Nonce | Unique transaction identifier used to prevent replay attacks. |

| Smart Contract | Program that governs multi-sig logic (common in Ethereum). |

How it fits into the Cryptoblockcoins Lifecycle:

- Wallet Creation: Keys are generated and distributed among owners.

- Transaction Proposal: One owner proposes a transaction.

- Signature Collection: M required signatures are collected.

- Broadcast: Transaction is signed and broadcasted to the blockchain.

- Confirmation: Blockchain confirms the transaction; funds are moved.

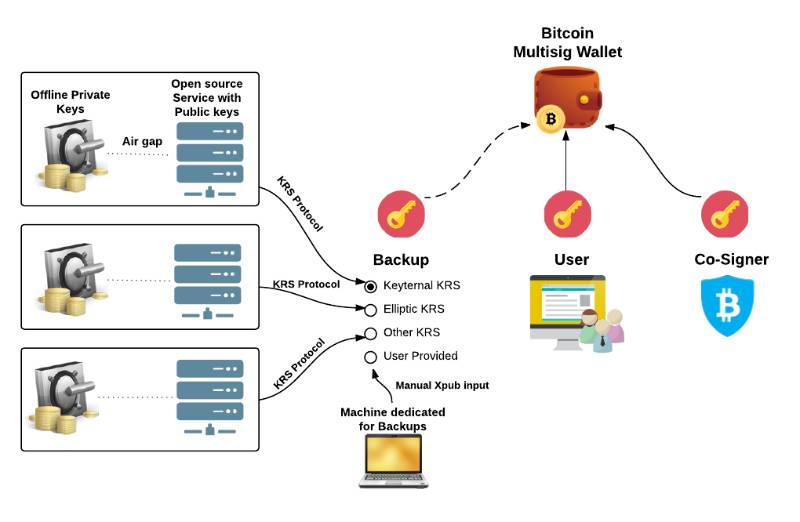

3. Architecture & How It Works

Components

- Wallet Interface: Web or mobile app for creating, signing, and proposing transactions.

- Key Holders: Users holding private keys, each controlling part of the wallet.

- Transaction Manager / Smart Contract: Validates signatures and executes transactions.

- Blockchain Node: Broadcasts transactions to the network.

Internal Workflow

- Propose transaction via wallet interface.

- Wallet generates a partially signed transaction.

- Signers review and append their signatures.

- Once M signatures are collected, the transaction is considered valid.

- Transaction is broadcasted to the blockchain network for inclusion in a block.

Architecture Diagram Description

Since an image cannot be directly generated in text, here’s how to visualize it:

+----------------+

| Wallet Interface|

+--------+-------+

|

v

+---------------+

| Transaction |

| Manager / SC |

+-------+-------+

|

+--------+--------+

| |

+-----v-----+ +-----v-----+

| Signer 1 | | Signer 2 |

+-----------+ +-----------+

| |

+--------+--------+

v

+---------------+

| Blockchain |

| Node / Network|

+---------------+

- Wallet Interface: UI to propose, track, and sign transactions.

- Transaction Manager / Smart Contract: Verifies signatures and executes transaction.

- Signers: Key holders providing signatures.

- Blockchain Node: Network broadcasting validated transactions.

Integration Points with CI/CD or Cloud Tools

- Continuous Integration: Automated testing for smart contract code (Truffle, Hardhat).

- Deployment Pipelines: Scripts to deploy Multi-Sig wallets on testnet/mainnet.

- Monitoring Tools: Cloud-based dashboards to track pending transactions.

- Security Audits: Integrate automated static code analysis for smart contracts.

4. Installation & Getting Started

Basic Setup / Prerequisites

- A supported cryptocurrency (Bitcoin, Ethereum, etc.)

- Node.js / npm for Ethereum-based Multi-Sig

- CLI or web interface for Bitcoin Multi-Sig

- Basic knowledge of wallets and blockchain

Hands-on: Step-by-Step Beginner-Friendly Guide

Example: Bitcoin 2-of-3 Multi-Sig Wallet

- Install Bitcoin Core:

sudo apt-get install bitcoin-qt

- Generate three private keys:

bitcoin-cli createwallet "multiwallet1"

bitcoin-cli getnewaddress

bitcoin-cli dumpprivkey <address>

(Repeat for 3 keys)

- Create 2-of-3 Multi-Sig address:

bitcoin-cli createmultisig 2 '["<pubkey1>", "<pubkey2>", "<pubkey3>"]'

- Fund the Multi-Sig Wallet

bitcoin-cli sendtoaddress <multisig_address> 0.5

- Sign the Transaction:

bitcoin-cli signrawtransactionwithkey <hex_tx> '["<privkey1>", "<privkey2>"]'

- Broadcast Transaction:

bitcoin-cli sendrawtransaction <signed_tx>

This ensures two signatures out of three are required for funds transfer.

5. Real-World Use Cases

| Scenario | Description |

|---|---|

| Corporate Treasury | Multi-Sig wallets control company crypto assets; multiple executives must approve large transactions. |

| Decentralized Autonomous Organizations (DAOs) | Governance tokens require multi-signature approval for proposal execution. |

| Escrow Services | Buyer, seller, and platform each hold a key; funds release only when conditions are met. |

| Crypto Exchanges | Multi-Sig wallets are used for cold storage of user funds to enhance security. |

6. Benefits & Limitations

Key Advantages

- Enhanced security

- Reduced single-point-of-failure risk

- Supports decentralized governance

- Allows shared control over assets

- Ideal for compliance and audit trails

Common Challenges / Limitations

- Slower transaction process (requires multiple approvals)

- Risk of lost keys locking funds permanently

- Complexity in user management

- Higher learning curve for non-technical users

7. Best Practices & Recommendations

| Practice | Recommendation |

|---|---|

| Security | Use hardware wallets; distribute keys geographically. |

| Redundancy | Backup each private key securely. |

| Maintenance | Periodically verify key availability and test transactions. |

| Smart Contract Audit | For Ethereum Multi-Sig, always audit the smart contract. |

| Threshold Strategy | Choose M-of-N wisely balancing security and convenience. |

8. Comparison with Alternatives

| Feature | Standard Wallet | Multi-Sig Wallet | Custodial Wallet |

|---|---|---|---|

| Number of Keys | 1 | M-of-N | Custodian manages |

| Security | Low (single key) | High | Medium (depends on provider) |

| Decentralization | Full | Partial | Low |

| Recovery | Easy | Moderate (requires M keys) | Managed by custodian |

| Governance | Single owner | Shared control | Provider controls |

When to Choose Multi-Sig:

- For organizational funds requiring multiple approvals

- Escrow and trustless transactions

- Enhanced security for high-value accounts

- DAO or group-managed crypto assets

9. Conclusion

- Multi-Sig Wallets offer a robust solution for secure, shared, and auditable management of cryptocurrency.

- They mitigate risks associated with private key theft, provide redundancy, and enable decentralized governance.

- Future Trends:

- Integration with DeFi protocols

- Smart-contract-based Multi-Sig for layer-2 solutions

- Automated compliance and auditing tools

Next Steps:

- Experiment with testnets to create your own Multi-Sig wallets.

- Audit and integrate smart contract Multi-Sigs for Ethereum or other platforms.

- Explore Multi-Sig wallets in decentralized organizations and escrow services.

Official Resources & Communities:

- Bitcoin Wiki – Multi-Signature

- Gnosis Safe – Ethereum Multi-Sig

Category: