1. Introduction & Overview

What is a Utility Token?

A Utility Token is a type of cryptocurrency designed to provide access to a product or service within a blockchain ecosystem. Unlike traditional currencies, utility tokens are not primarily used as a store of value but to unlock functionalities or rights in a decentralized application (dApp).

Key Highlights:

- Grant users access to features/services of a platform.

- Can incentivize user behavior (e.g., staking, governance participation).

- Usually created via smart contracts on blockchains like Ethereum, Binance Smart Chain, or Solana.

History & Background

- Early utility tokens emerged during Initial Coin Offerings (ICOs) in 2017–2018.

- Example: Ethereum’s ERC-20 tokens were widely used for ICOs to fund projects while providing access to services.

- Transition from ICOs to STOs (Security Token Offerings) and utility-focused token economies due to regulatory scrutiny.

Relevance in Cryptoblockcoins

Utility tokens act as internal fuels for blockchain ecosystems, enabling:

- Microtransactions without traditional banking.

- Access to premium services inside decentralized platforms.

- Incentivization of users and developers for ecosystem growth.

2. Core Concepts & Terminology

| Term | Definition |

|---|---|

| Token | Digital asset representing rights or access within a blockchain platform. |

| Utility Token | Provides access to services/products within a blockchain ecosystem. |

| Smart Contract | Self-executing contract with rules encoded in blockchain code. |

| dApp | Decentralized application that leverages blockchain and token usage. |

| Gas Fee | Payment in crypto for executing blockchain transactions. |

| ERC-20 / BEP-20 | Blockchain token standards on Ethereum/Binance Smart Chain. |

| Tokenomics | Economic model defining token supply, utility, and distribution. |

| Staking | Locking tokens to support the network or earn rewards. |

| ICO / IEO / IDO | Methods to distribute tokens to users or investors. |

How Utility Tokens Fit in the Lifecycle

- Creation – Defined in smart contracts; typically ERC-20 or BEP-20.

- Distribution – ICO, airdrops, or staking rewards.

- Usage – Accessing services, paying for transaction fees, participating in governance.

- Burn / Incentivization – Some platforms reduce token supply over time or reward active participants.

3. Architecture & How It Works

Components

- Blockchain Network: Ethereum, Binance Smart Chain, or other platforms supporting smart contracts.

- Smart Contracts: Encode rules for token issuance, transfers, and usage.

- User Wallets: MetaMask, TrustWallet, etc., to store and use tokens.

- dApp Interface: Web/mobile apps where users spend or stake tokens.

- Nodes / Validators: Ensure transaction confirmation and security.

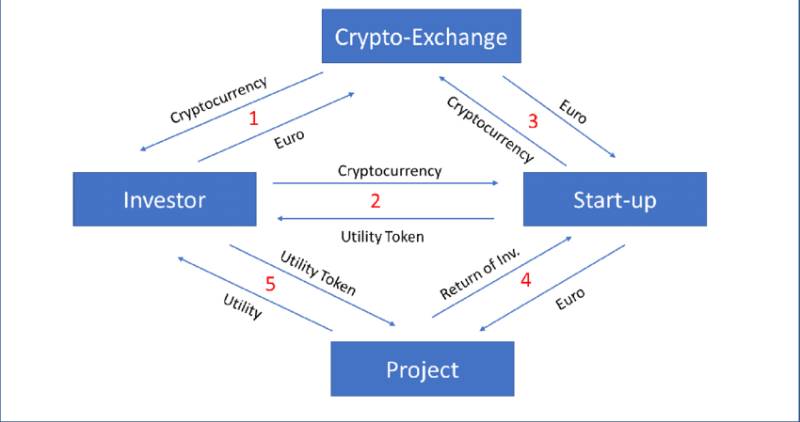

Internal Workflow

- User acquires utility tokens via ICO/IEO or exchange.

- Tokens are stored in a wallet.

- User sends tokens to a smart contract to access services or participate in a platform function.

- Smart contract verifies the token and unlocks the service.

- Transaction is confirmed on the blockchain.

Architecture Diagram (Descriptive)

+-------------------+

| User Wallet |

+--------+----------+

|

v

+--------+----------+

| dApp UI |

+--------+----------+

|

v

+--------+----------+

| Smart Contract |

| (ERC-20 / BEP-20)|

+--------+----------+

|

-------------------------------

| |

v v

+-------------+ +-------------+

| Blockchain | | Tokenomics |

| Network | | Module |

+-------------+ +-------------+

This shows user → wallet → dApp → smart contract → blockchain + tokenomics.

Integration Points

- CI/CD for smart contract deployment: GitHub Actions, Truffle, Hardhat.

- Cloud hosting: AWS, GCP, Azure for frontend and API services.

- Monitoring tools: Tenderly, Etherscan, BscScan for contract analytics.

4. Installation & Getting Started

Prerequisites

- Node.js & npm installed.

- Metamask wallet.

- Basic knowledge of Solidity (for Ethereum).

- Blockchain testnet setup (Ropsten / Binance Testnet).

Step-by-Step Beginner Setup

- Initialize Node Project

mkdir utility-token && cd utility-token

npm init -y

npm install ethers hardhat

- Create Hardhat Project

npx hardhat

# Choose "Create a basic sample project"

- Write Token Contract

// SPDX-License-Identifier: MIT

pragma solidity ^0.8.0;

import "@openzeppelin/contracts/token/ERC20/ERC20.sol";

contract UtilityToken is ERC20 {

constructor(uint256 initialSupply) ERC20("UtilityToken", "UTK") {

_mint(msg.sender, initialSupply);

}

}

- Deploy Contract

async function main() {

const [deployer] = await ethers.getSigners();

const Token = await ethers.getContractFactory("UtilityToken");

const token = await Token.deploy("1000000");

console.log("Token deployed at:", token.address);

}

main();

- Test on Testnet

- Configure

hardhat.config.jswith Ropsten/BSC testnet RPC. - Deploy and verify using etherscan API.

5. Real-World Use Cases

| Project | Token | Use Case |

|---|---|---|

| Filecoin | FIL | Storage access and incentives for decentralized cloud storage. |

| Basic Attention | BAT | Reward users for viewing ads; advertisers buy ad slots using BAT. |

| Golem Network | GNT | Pay for decentralized computing power and resources. |

| Helium | HNT | Access IoT network coverage; rewards miners for contributing coverage. |

Industry Examples:

- Entertainment: Tokens for premium content access.

- Gaming: In-game currencies or NFTs powered by utility tokens.

- IoT Networks: Paying for network bandwidth and device communication.

6. Benefits & Limitations

Key Advantages

- Fast, low-cost microtransactions.

- Incentivizes user participation.

- Promotes decentralized ecosystems.

- Programmable: automation via smart contracts.

Common Challenges

- Regulatory scrutiny in some countries.

- Overhyped ICOs leading to failed projects.

- Token value volatility despite utility focus.

- Technical knowledge required to implement securely.

7. Best Practices & Recommendations

Security & Maintenance:

- Always audit smart contracts.

- Implement rate limiting and anti-bot measures in dApps.

- Use multisig wallets for treasury management.

Compliance & Automation:

- Consider jurisdictional regulations.

- Automate token distribution and staking rewards.

- Keep logs and analytics for token usage.

8. Comparison with Alternatives

| Type | Purpose | Example |

|---|---|---|

| Utility Token | Access to services/products inside ecosystem | BAT, FIL |

| Security Token | Represents ownership or investment rights | tZERO, Polymath |

| Governance Token | Voting on protocol changes | UNI, COMP |

| Stablecoin | Stable value, often pegged to fiat | USDC, DAI |

When to Choose Utility Token

- Project requires tokenized access to services.

- Incentivizing user activity or participation.

- Not primarily an investment vehicle.

9. Conclusion

Utility tokens are the backbone of decentralized ecosystems, providing access, incentives, and automation. They power dApps, blockchain services, and innovative micro-economies.

Future Trends:

- Integration with Layer 2 scaling solutions.

- Cross-chain interoperability.

- Increasing regulation with compliance-friendly token models.

- Tokenization of real-world services and resources.

Next Steps:

- Experiment with testnets and token deployment.

- Explore staking, liquidity mining, and DeFi integrations.

- Monitor token performance and user adoption.

Official Resources:

- Ethereum ERC-20 Docs

- OpenZeppelin Contracts

- Binance Smart Chain Docs